Fantastic Tips About What Is The Most Repeated Chart Pattern Ggplot Mean Line

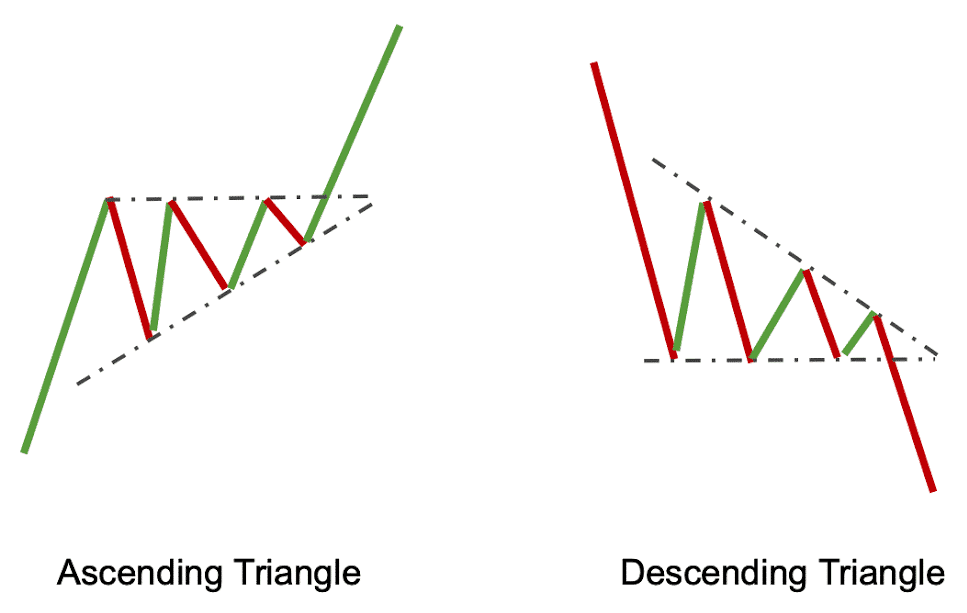

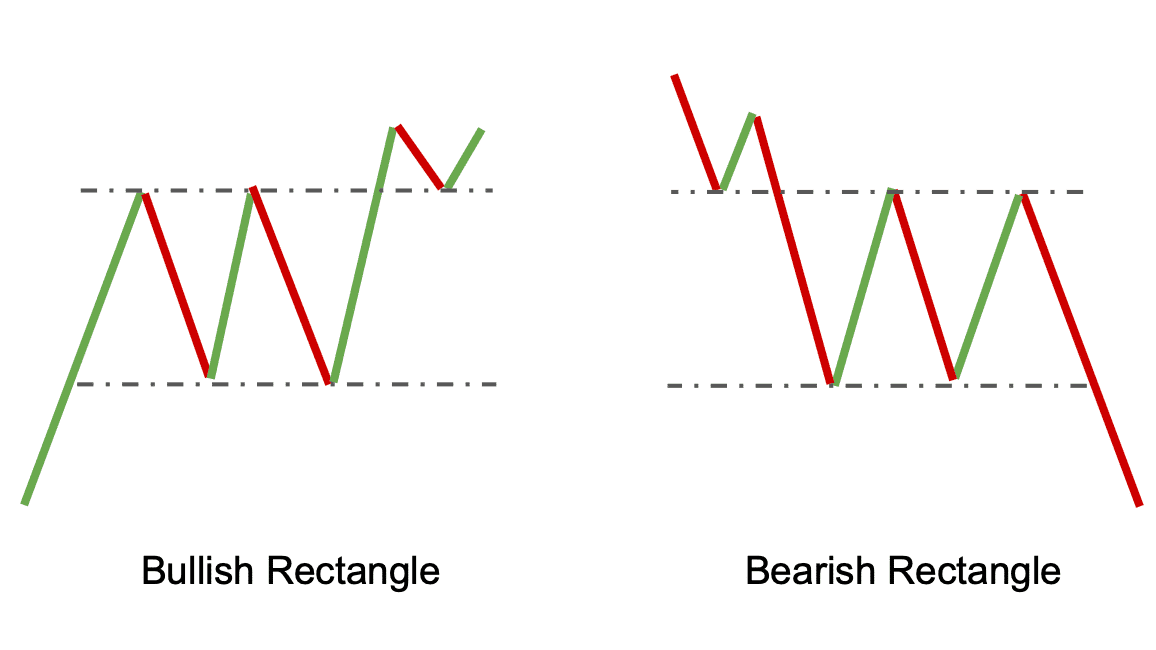

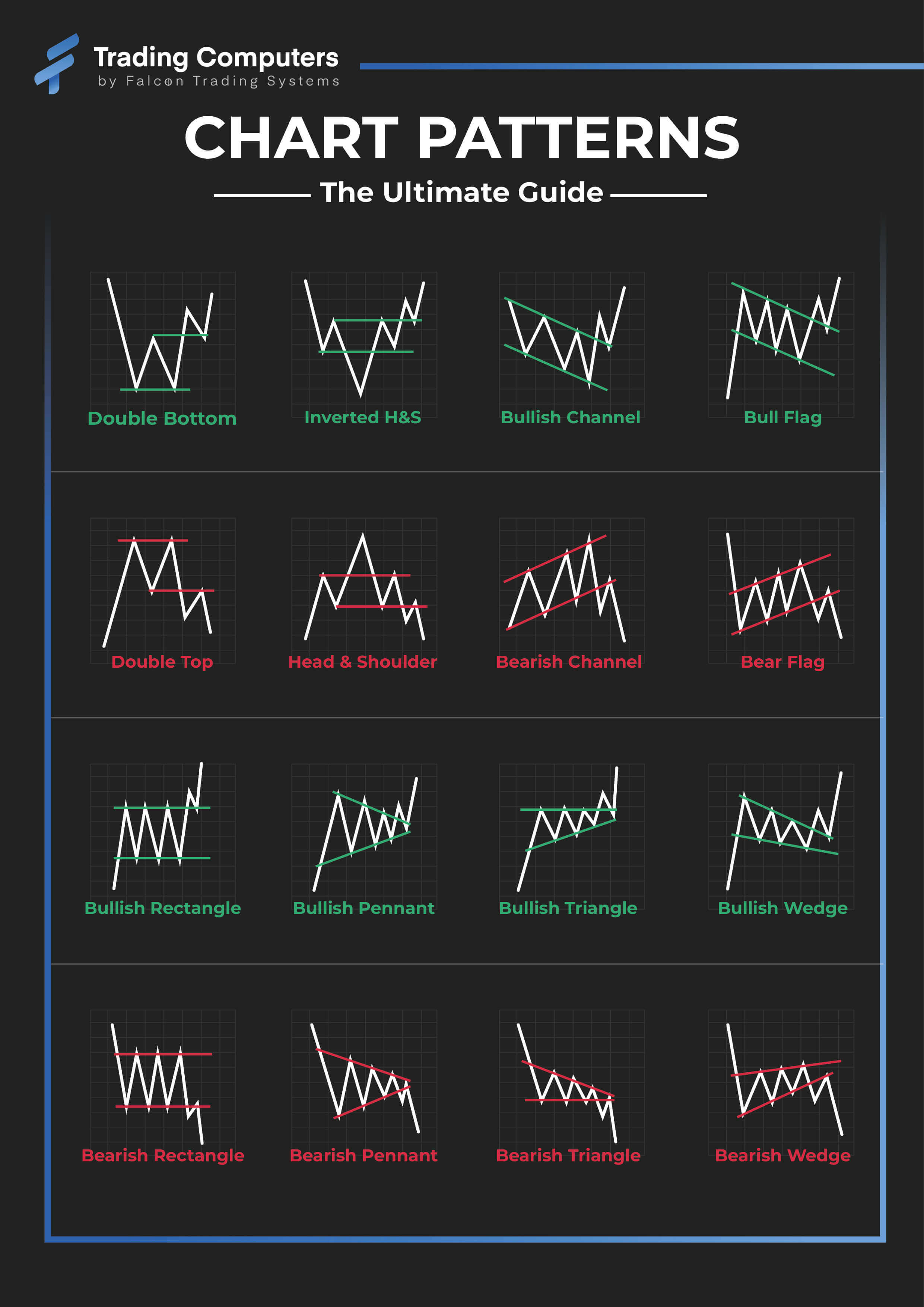

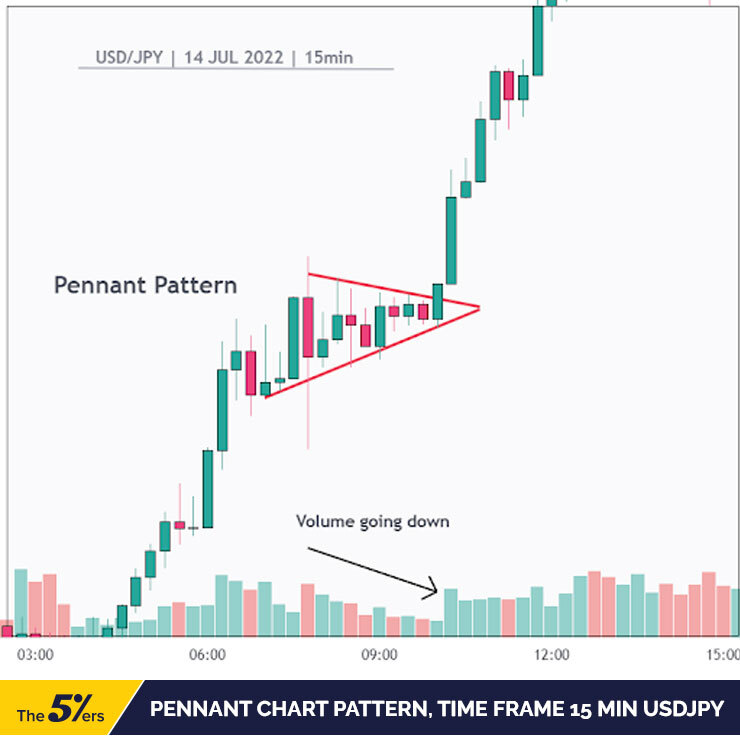

There are few common chart patterns that appear repeatedly and often lead to similar subsequent price movements.

What is the most repeated chart pattern. Chart patterns cheat sheet is an essential tool for every trader who is keen to make trading decisions by identifying repetitive patterns in the market. Ascending and descending staircases are probably the most basic chart patterns. Chart patterns is a group of indicators that automatically search for repeating price patterns on the chart.

Using charts, technical analysts seek to identify price patterns and market trends in financial markets and attempt to exploit those patterns. Stock charts display repeating human nature and market behavior. July 20, 2023 posted by cory mitchell, cmt day trading stocks info 15 comments.

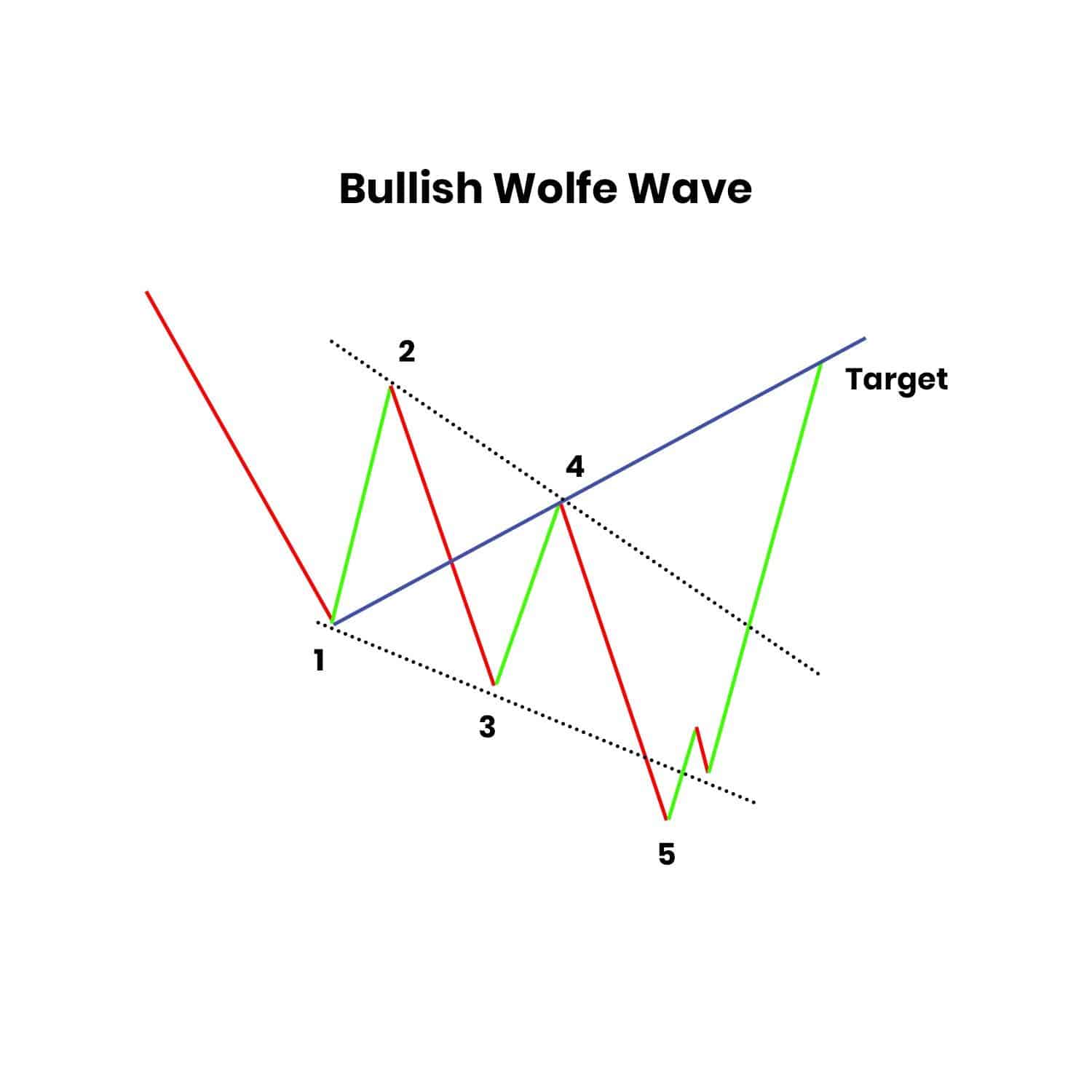

The idea behind chart pattern analysis is that by knowing what happened after a pattern in the past, you. However, it’s important to note that past performance does not guarantee future results. According to thomas bulkowski, the best performing and also most likely to be profitable chart patterns are:

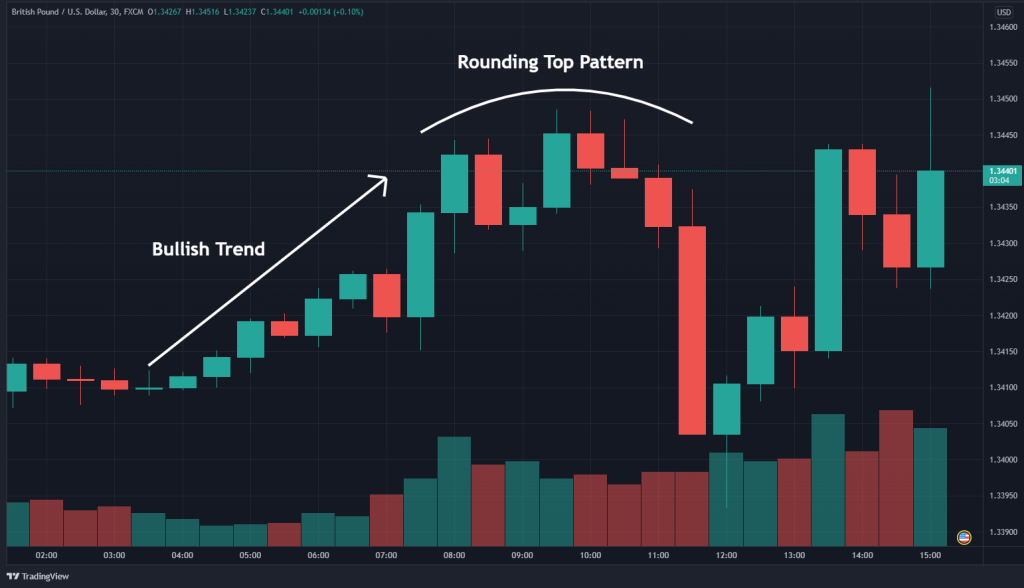

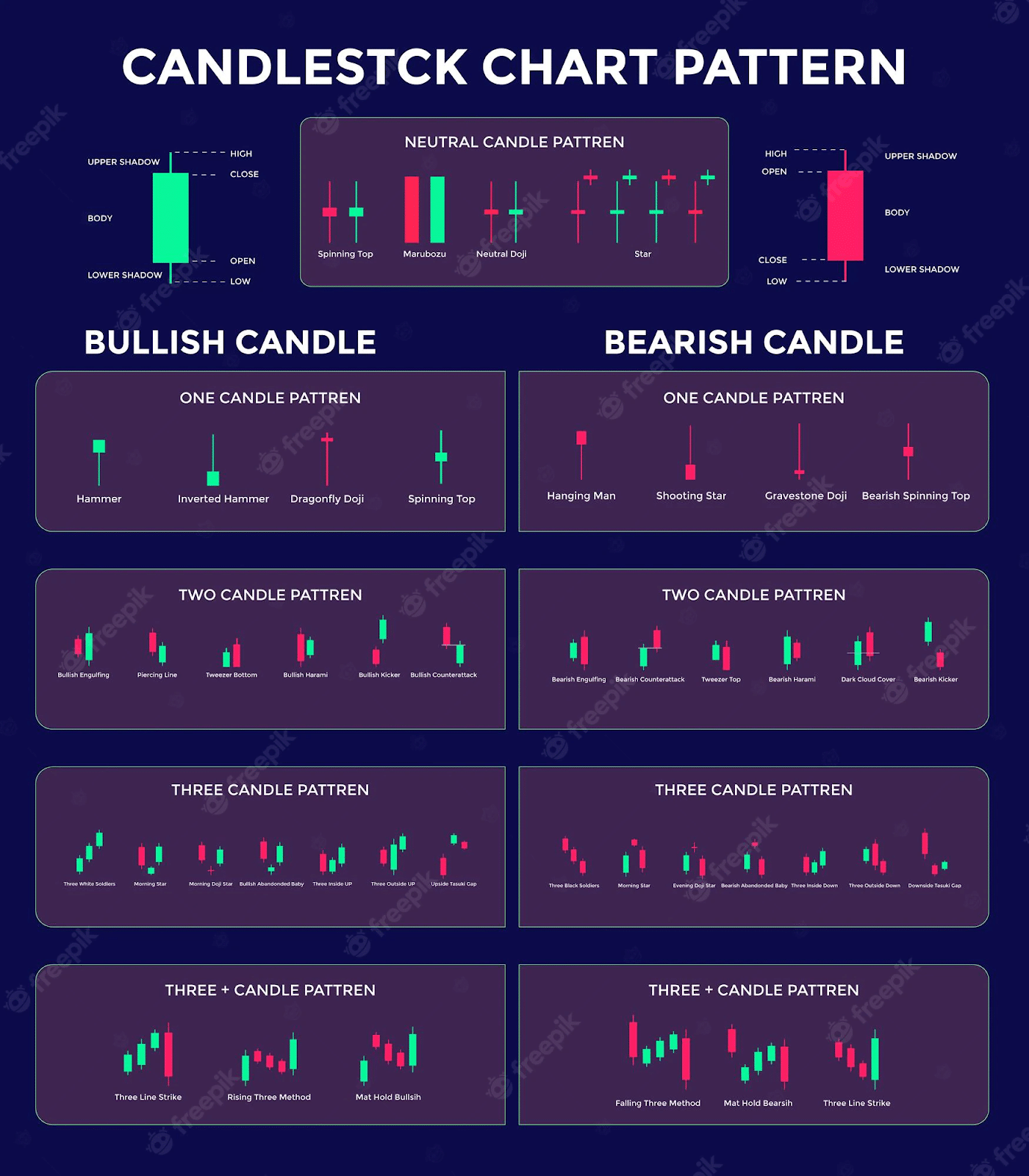

Bearish engulfing, bullish engulfing, hammer, shooting star, morning star, evening star, bullish. If you watch an intraday chart of the spdr s&p 500 etf (spy), for example, you’ll see that it tends to trend and reverse at similar times. Below are some of the most popular and trusted stock chart patterns traders leverage today.

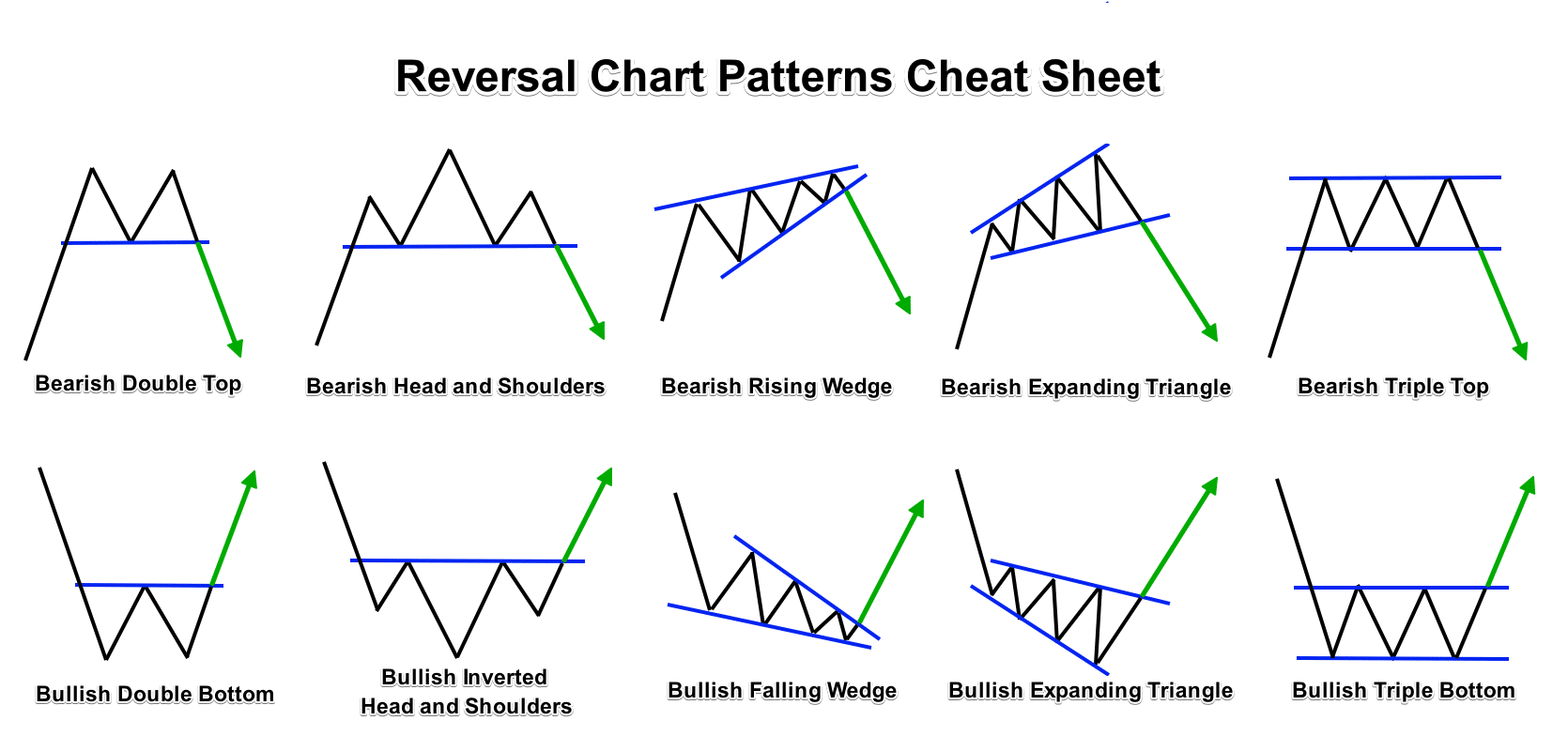

An ending wedge forex pattern occurs when the market keeps making higher highs and higher lows, but the rallies are losing momentum. Chart patterns play a crucial role in technical analysis, helping traders and investors anticipate future price movements based on past trends. These recurring patterns can form a basis.

But they’re still important to know if you’re interested in identifying and trading trends. A chart pattern is a set price action that is repeated again and again. Each of these patterns has a unique shape and provides a.

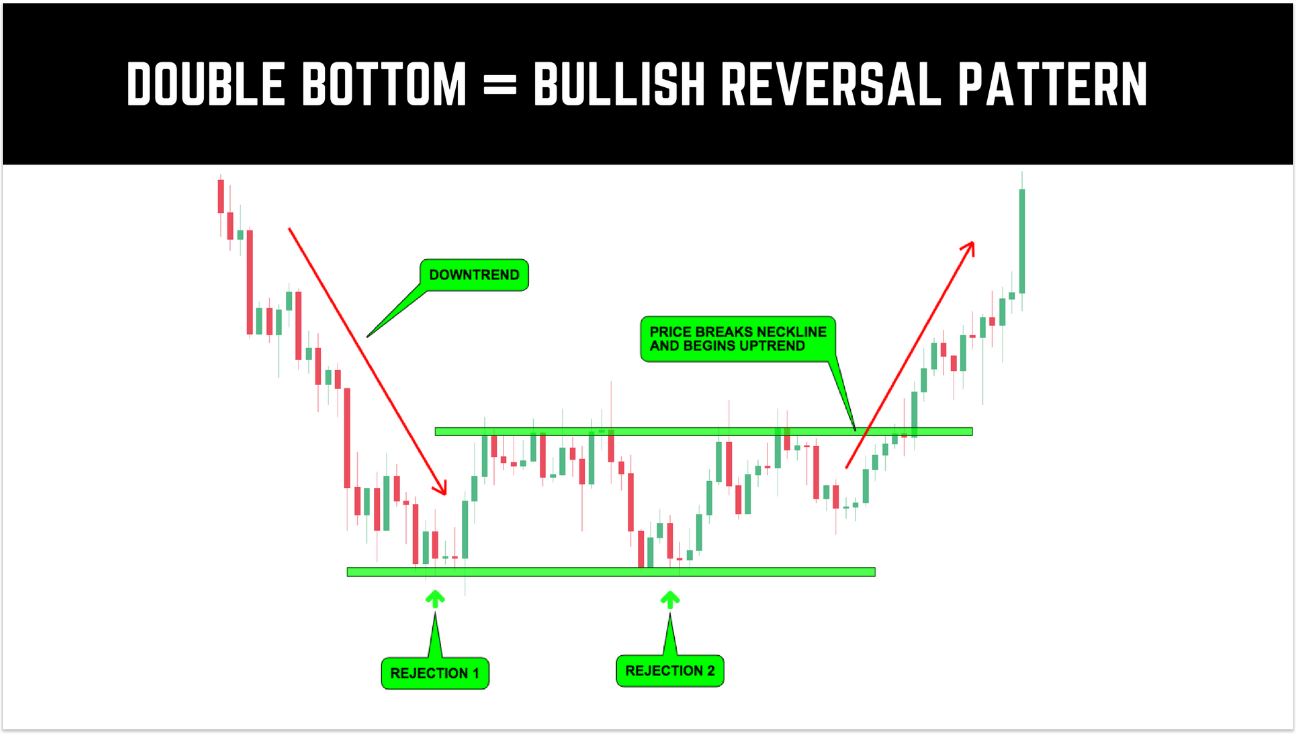

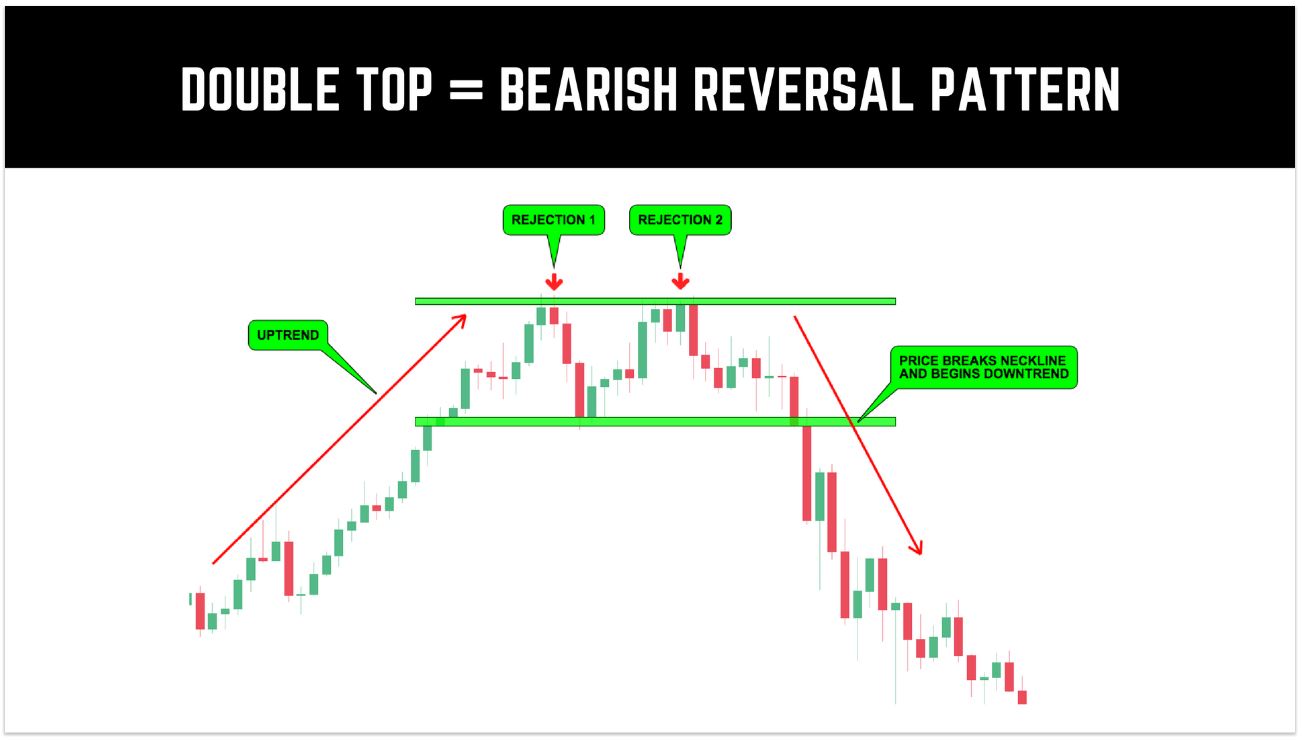

Published research shows the most reliable and profitable stock chart patterns are the inverse head and shoulders, double bottom, triple bottom, and. Some of the most common reversal chart patterns include head and shoulders, double and triple tops/bottoms. In this guide, we’ll dive into some of the most pivotal chart patterns:

Table of contents. Bullish flags that are high and tight that breakout to the. In this article, we will.

There are numerous chart patterns that form with considerable consistency in the markets, and traders often see them as the holy grail of stock trading. Head and shoulders. A chart pattern is a specific formation on a price chart that is repeated over time.

Head and shoulders pattern: For each stock chart pattern, i’ve highlighted. When it comes to trading, a trading chart pattern is a stable and repeated combination of data on prices, volumes, or indicators.

![Diamond Chart Pattern Explained [Example Included]](https://srading.com/wp-content/uploads/2022/12/diamond-chart-pattern-top.jpg)