Out Of This World Tips About Are Higher Lows Bullish Or Bearish Google Sheets Add Horizontal Line To Chart

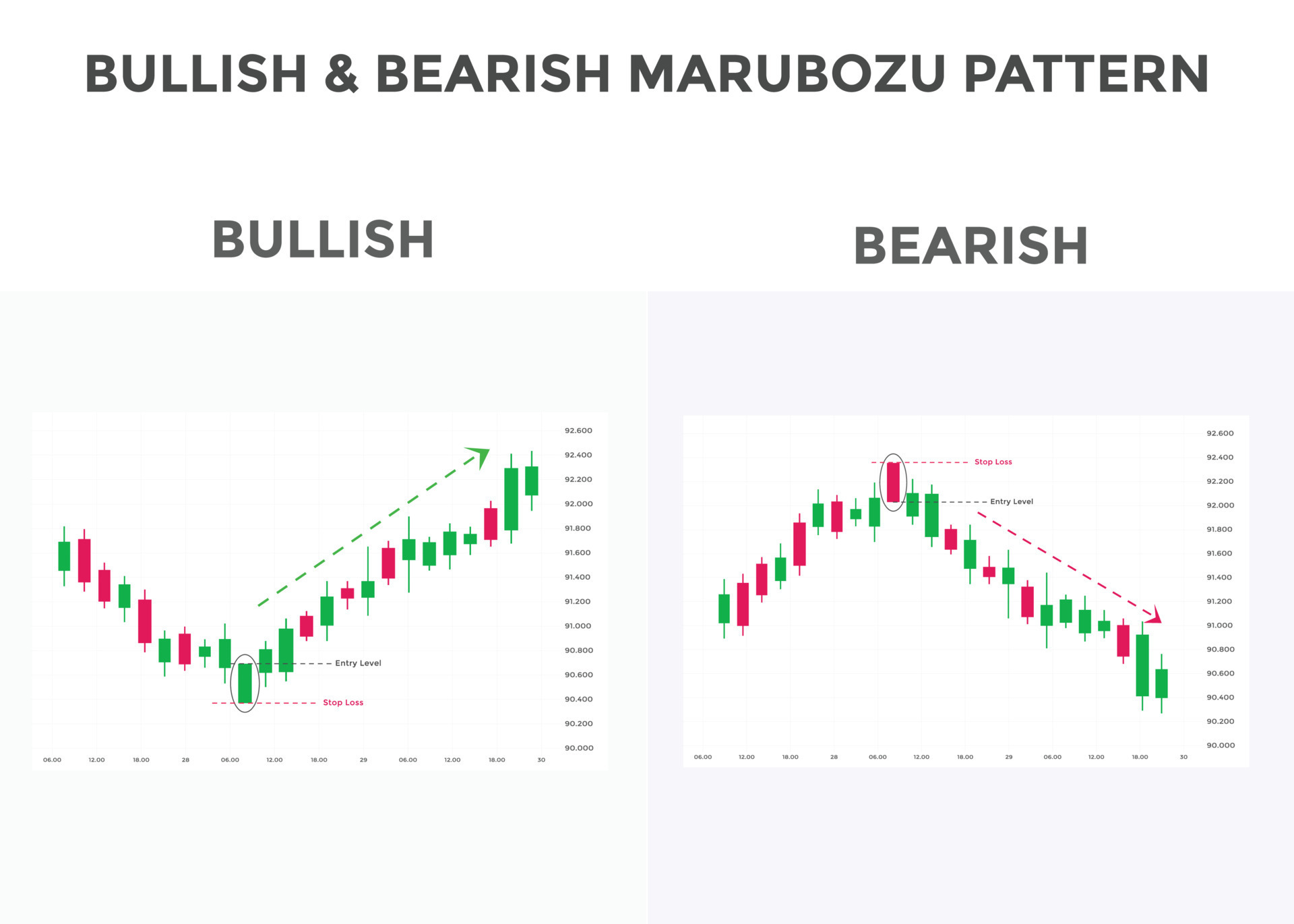

Please keep in mind that these forex patterns can all be reversed to highlight a bullish scenario instead.

Are higher lows bullish or bearish. An ascending channel is a technical analysis pattern comprising a series of higher highs and higher lows. Since you’ve all be studying hard and not been cutting class, we’ve decided to help y’all out (cause we’re. Another approach is to analyze whether the market is forming higher highs and lower lows over recent periods.

How higher lows indicate a bullish trend. Rising triangle chart pattern signal bullish continuations while a falling triangle is a bearish continuation pattern. In this blog we will look at bearish formations.

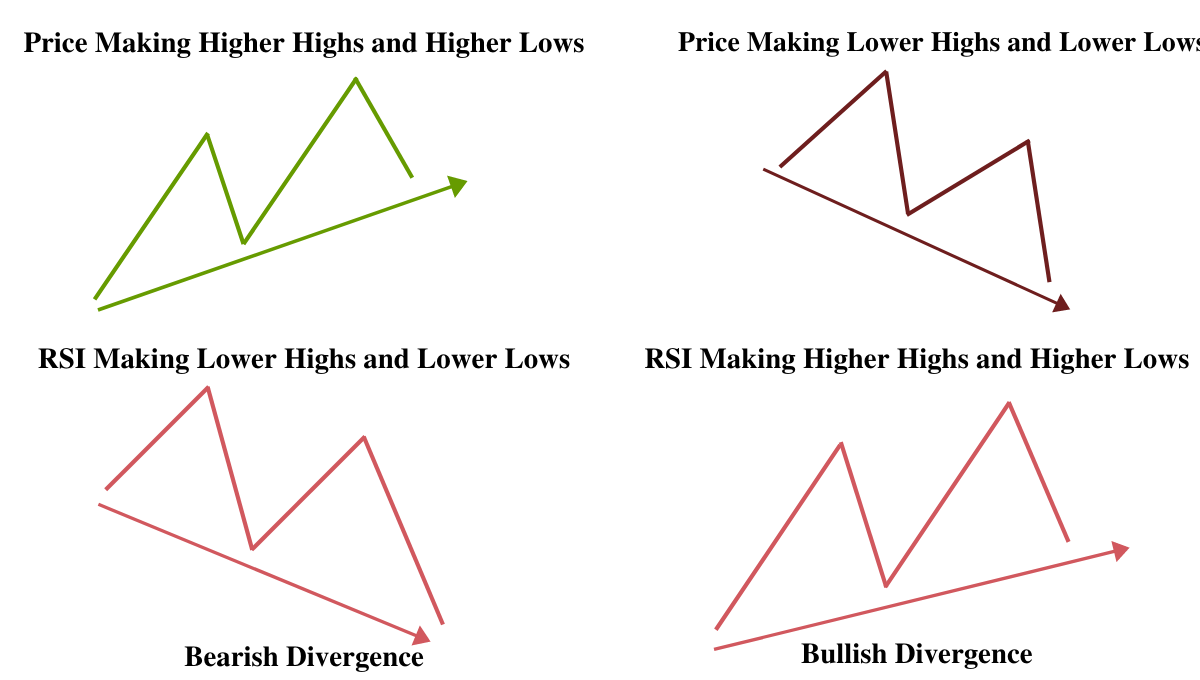

Bullish hidden divergences are characterized by the asset’s price showing higher lows. It provides traders with prices to either sell or short. Rising wedges is a chart pattern that occurs in a market making higher highs and higher lows, signalling a bearish reversal.

Bullish sentiment means the majority of people in the market. Higher highs and lower lows. Watch for breakouts above or below the upper.

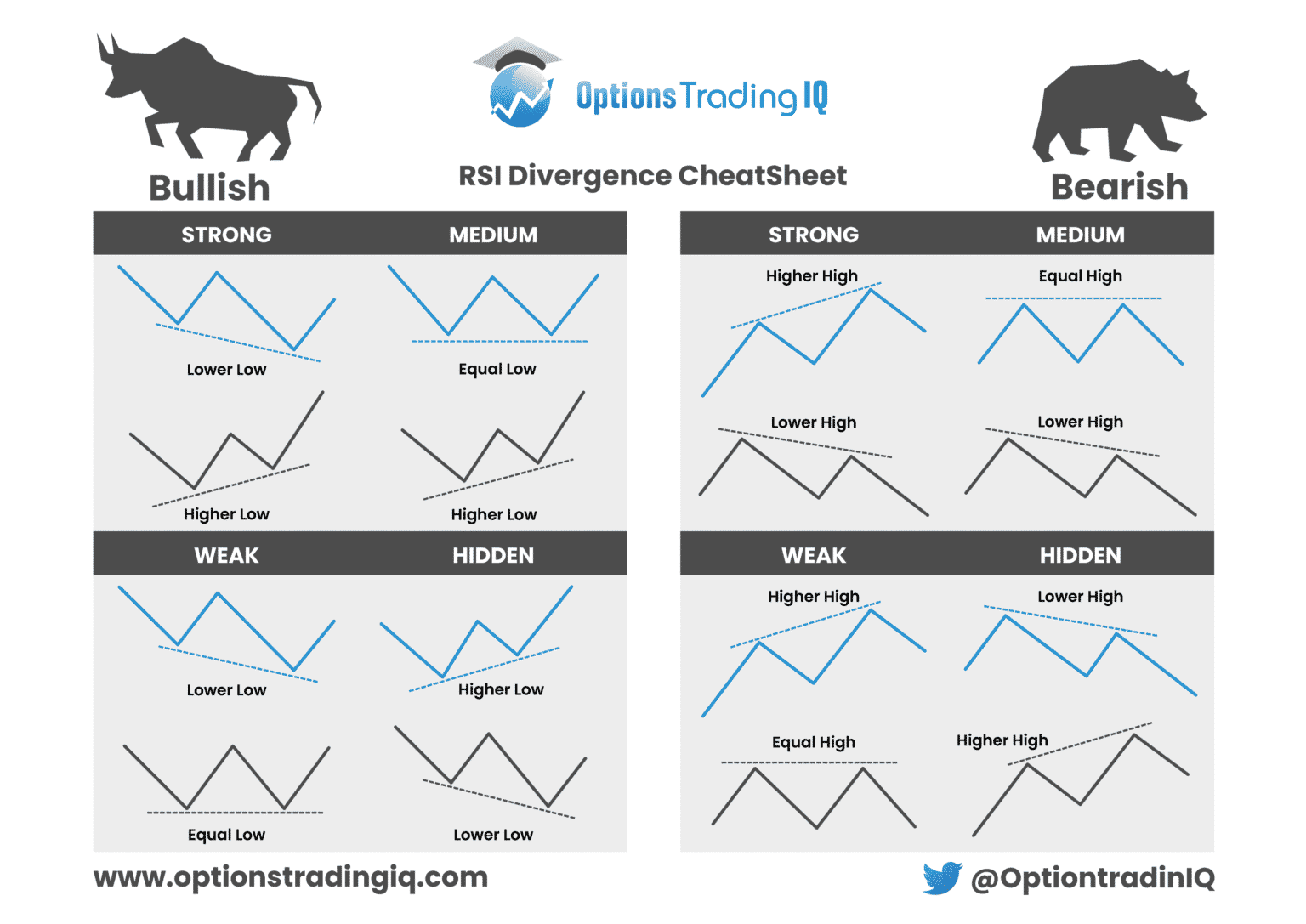

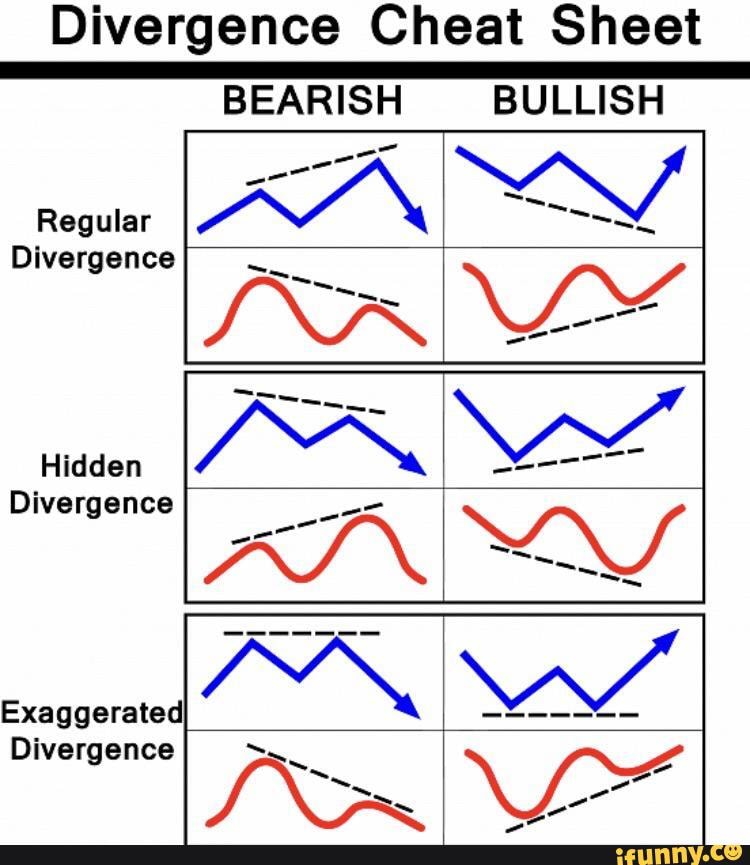

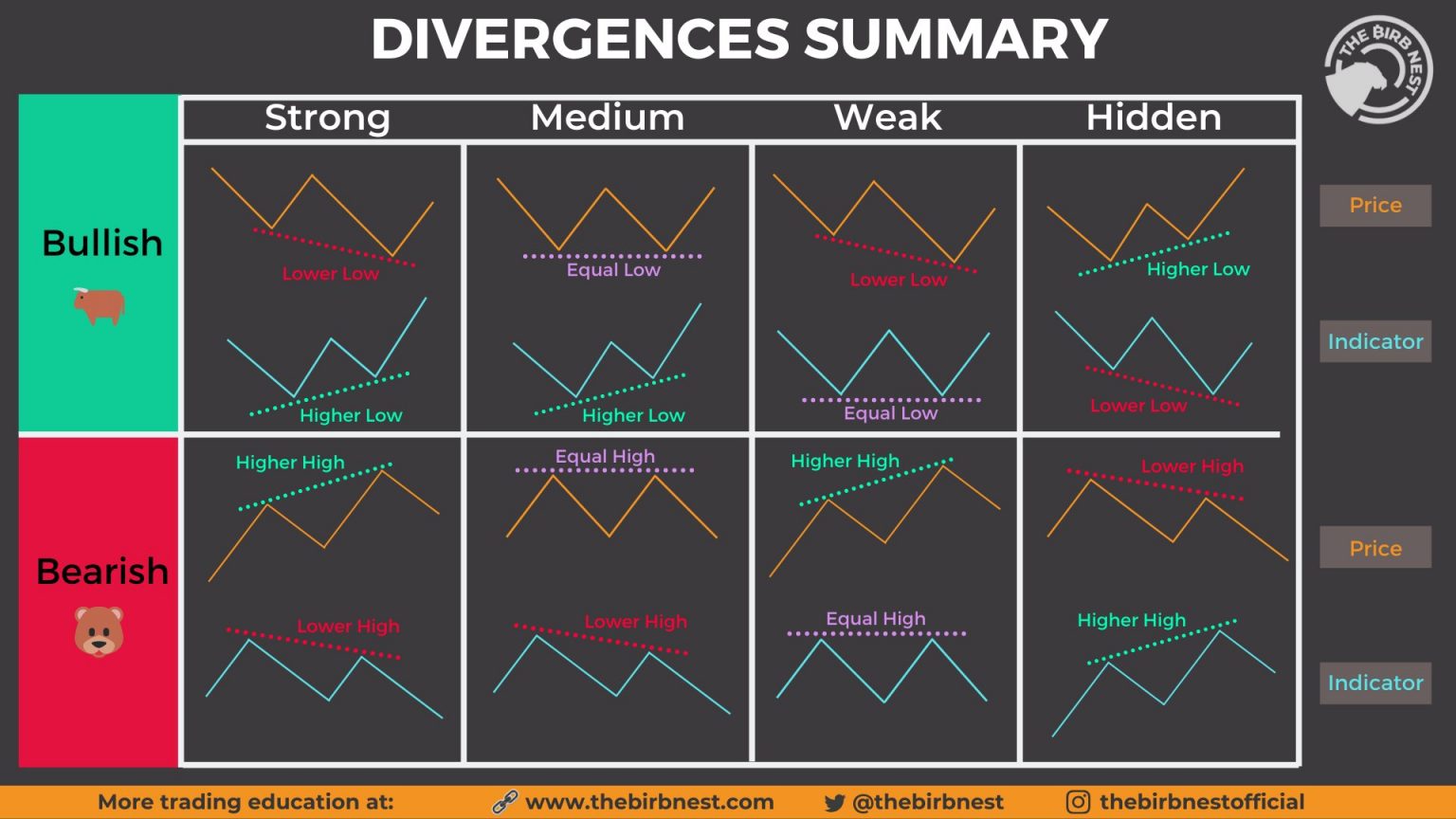

A bullish divergence occurs when the price makes lower lows but the indicator makes higher lows, hinting that the downtrend may soon reverse or at least. Like regular divergences, hidden divergences can be bullish or bearish. Polygon’s recent price movement has been characterized by a bearish trend, reflecting a decline in investor enthusiasm for this particular cryptocurrency.

Bullish and bearish divergences enable you to trade market reversals. The continuous natural gas futures contract closed out 2023 at $2.514 and was 15.8% higher at $2.912 per mmbtu on june 25. This pattern, where each low is higher than the.

When this recurring pattern ends, it is a sign the trend. Lower lows on the price (or lows at the same level) , and higher lows on the rsi is bullish divergence The most significant advantage of trading divergences is that they provide you with trading signals before the.

A price chart showcasing bullish divergence is characterized by the formation of progressively lower lows by the price candles when the signal line of the oscillator forms. It occurs when price makes a higher high or lower low and the momentum indicator or oscillator will do the opposite (make a higher high if price makes a lower. The xle closed out 2023 at $83.84 per.

Conversely, higher lows suggest an emerging bullish trend. When traders mention a “higher low,” they refer to a point on a chart where the price of an asset is higher than the previous low, indicating potential bullish momentum. Bullish sentiment is investors’ collective opinion toward a certain stock or market.

Conversely, a “lower high” indicates a price point that is lower than the. Higher highs and higher lows consecutively are a bullish sign that an uptrend is forming or contributing. Each type of divergence will contain either a bullish bias or a bearish bias.

/what-do-long-short-bullish-and-bearish-mean-1030894-v2-94771b18dbf54fb8a7f624297405acf4.png)